When she was a young girl, Tasha Danielle’s grandmother would lay out her bills and explain both the importance and how she paid each one off.

Danielle listened. It was these formative lessons that allowed her to become a CPA for DTE Energy … and payoff $80,000 in debt she’d accumulated before age 30.

That debt came mostly from college – $53,000 in student loans. Other contributors were money for books, an apartment, and $17,000 in car loans.

Knowing where her fiscal acumen came from, Danielle wanted to share the information with younger generations. With this thought, in 2014 she founded The Financial Garden, an after-school program to teach financial literacy to K-12 students using a hands-on approach including interactive games and activities appropriate for any age.

She has taught many young people since she founded the organization six years ago and says her aim is to increase the total number.

“My goal is to teach 10,000 kids financial literacy by the end of the year” says Danielle, who teaches two classes a week.

All classes focus on the basics such as financial planning, stocks and bonds, bank basics, and even the path to start a business. While the same subjects are covered in all classes, the teaching is age-based.

For elementary school students it is more to foster a basic understanding of finance. While other aspects are discussed, Danielle stresses the importance of saving,

To help show the young people how things work, she created a store for the class and stocked it with items they can buy with the “money” she created. Kids get “paid” for notable work, such as answering a question correctly.

This gives a direct look at how the kids are developing the skills she is teaching.

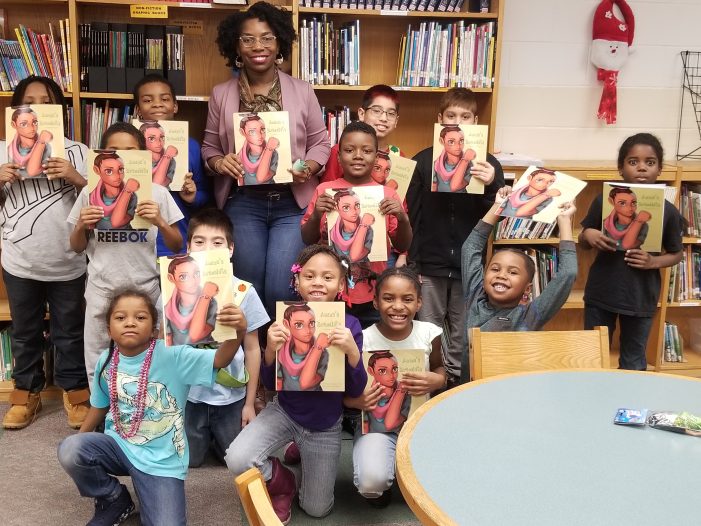

Another tool she uses is reading from a children’s book she wrote called ”Amina’s Bracelet: A Kidpreneur Story.” The book is about how a nine-year-old girl earns her own money to purchase a tablet when her parents said they would not buy it for her.

For high school students the focus is more on real-world applications such as how to budget for rent, save money, pick stocks, and deal with any other financial hurdles that may come up in their lives.

Danielle has seen such success with her students she is considering starting a class for teach adults.

The recent pandemic has not slowed her down. She kept the classes up through Zoom and Google Meet, as well with online assignments for kids to follow.

This success is why Danielle entered the Pine-Sol and ESSENCE Build Your Legacy Competition to help grow The Financial Garden. That program invests in black female entrepreneurs who are making a positive economic impact in their communities.

Danielle, a semi-finalist, won $15,000.

“My colleagues at DTE were a big help with the push to get people to vote for the Pine-Sol and ESSENCE Build Your Legacy Competition,” she says. This created huge awareness for The Financial Garden.”

One of the things she did with the money was to create an additional website, which allows educators to check out The Financial Garden’s curriculum and get ideas about how to teach financial literacy to children they instruct.

For more information on The Financial Garden for their services, click here.